SQX 2024 Year-in-Review

Note from the CEO

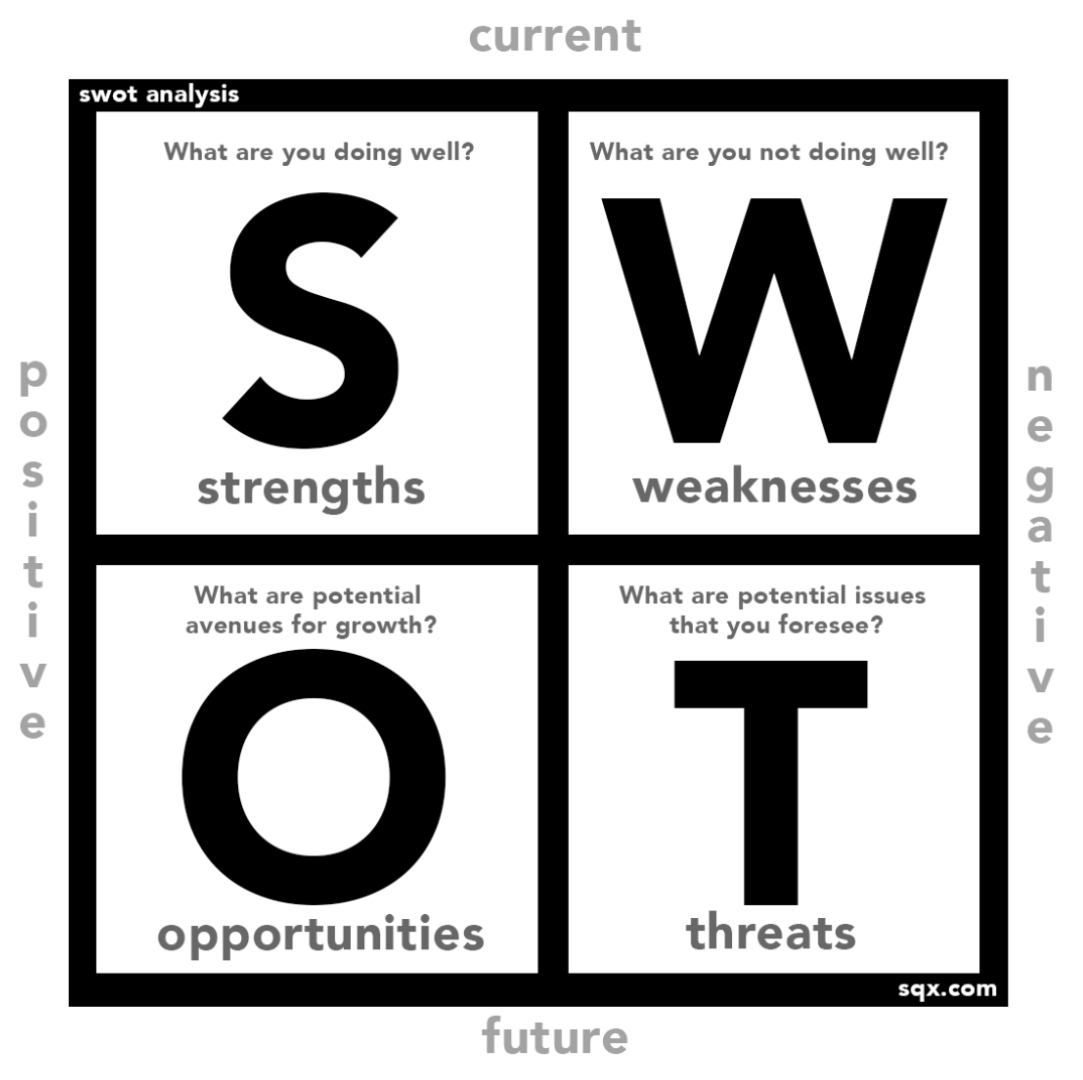

At SQX, continuous improvement is not only one of our key values—it’s the foundation of how we serve you. Continuous improvement means that we never stop refining our processes to make them faster, smoother, and better able to support you. But it’s also about growth—looking for opportunities to meet needs in new and creative ways.

In 2024, our core SQX products improved significantly. We laid the foundation for offering muni reference data. We began providing yield curves, giving you access to data on global curves, corporate curves, and municipal curves. And we hit a fun milestone with our structured note pricing.

But continuous improvement also took a surprising form—we launched two brand-new organizations under the SQX umbrella! SQX Alts features daily alternative investments news and information. SQX Bonds offers corporate bond data for the world of retail investing.

We know that none of this would be possible without your trust and support in 2024. We can’t wait to continue our pursuit of continuous improvement as the calendar shifts to 2025! Thank you for being part of our journey.

—Timothy Tatum, CEO of Securities Quote Xchange

Muni Reference Data Coming Soon

In Q4 2024, we laid the foundations for an exciting new service: municipal bond reference data! This initiative, developed in collaboration with our partners Municipal Bond Information Services (MBIS) and Exchange Data International (EDI), is set to launch in late 2025. Once this product is available, our clients will have access to high-quality reference data on over 1.5 million active U.S. muni bond issues from over 50,000 different issuers.

Our muni reference data will include essential information like bond terms, ratings, maturity dates, and issuance details, empowering clients to make more informed decisions and streamline compliance workflows. By combining this reference data with our existing pricing solutions, clients will have all the tools they need to navigate the complex muni bond landscape. Keep an eye on our future newsletters—we’ll have more muni reference data updates coming later this year.

SQX Covers 100,000 Structured Notes

In 2024, SQX reached a very important milestone for our structured note coverage: we now officially price over 100,000 structured notes! Reaching this milestone cements our position as the data vendor with the largest structured note coverage in the U.S., a title we hold thanks to our vast network of domestic and international dealers.

For our clients, this achievement means access to an even broader and more comprehensive dataset. Financial institutions can rely on SQX to deliver accurate, broker-quoted pricing for even the most complex and customized structured notes. SQX offers our structured notes clients regular intraday updates, customizable delivery options, and a single consolidated file, empowering them to efficiently manage their structured note investments.

As our universe of structured notes continues to expand, SQX remains committed to providing high-quality structured note data files that our clients can count on.

Added Yield Curves

In 2024, SQX released three new yield curve products! Our coverage includes global curves, corporate curves, and municipal curves.

Our global curves include data from 70 countries, spanning the full yield curve from overnight rates to long-term bond yields. SQX corporate curves cover a wide range of credit ratings (AAA to CCC), with full transparency into the constituents behind each curve. For municipal curves, our transparent, data-driven curves incorporate real-time market activity to ensure precise and accurate pricing.

With the addition of yield curves, we continue our mission to empower clients with timely, reliable, and comprehensive pricing data.

Introducing SQX Alts

In April 2024, we introduced SQX Alts, our new platform for alternative investments news and information. If you’re in the alts world, SQX Alts is built to simplify how you stay informed.

SQX Alts features daily articles that highlight recent developments with major issuers and sponsors. Site visitors can also browse a detailed directory of sponsors, sponsor-specific news articles, and publicly-issued securities. SQX Alts also includes an “announcements” feed, designed to keep you ahead of the curve. Instead of scouring the SEC website for updates, you can now find all the recent SEC filings from major alts issuers and sponsors in a single accessible list of announcements.

SQX Alts is just beginning to take off. As this website grows, we believe that SQX Alts will become the go-to resource for anyone who works with alts, whether you’re an investor, asset manager, custodian, issuer, or sponsor. Keep an eye out for more updates! We’re very excited for what’s ahead for SQX Alts in 2025…

Introducing SQX Bonds

In early 2024, SQX announced the release of SQX Bonds, a new web app that offers free fixed-income data for retail investors. Leveraging SQX’s high-quality bond data, SQX Bonds provides an open-access database that includes over 170,000 global corporate bonds and structured notes.

Retail investors often struggle with high costs and limited access to essential market information. SQX Bonds aims to address these barriers with free daily pricing updates, market yields, and historical price data for the bonds that interest them. Users can also create a free account to unlock advanced analytics, build fantasy portfolios, and join a discussion with other site users—all aimed at refining their investment strategies without incurring any costs.

SQX Bonds aims to set a new standard for retail fixed-income investing by making detailed financial insights available to everyone.

SQX would not be the organization it is today without you. Thank you for walking alongside us as we continue our journey of continuous improvement into 2025! To stay in the loop, make sure you follow us on LinkedIn and subscribe to our newsletter. We’re grateful that you’ve been a part of the SQX story.