Private Credit: On the Rise

An Ascending Asset Class

Private credit has become one of the fastest-growing asset classes in modern finance, stepping in to fill the gap left by traditional bank lending. Once considered a niche market, private credit is on track to grow to $2.8 trillion by 2028, up from $1.5 trillion in 20241. The picture couldn’t be clearer: private credit is poised to play a vital role in offering tailored financing solutions to borrowers and delivering attractive, risk-adjusted returns for investors. As this market expands, the need for accurate, reliable private credit pricing data will become more important than ever before.

What’s Driving Private Credit’s Growth?

The 2008 Global Financial Crisis marked a turning point for private credit. Stricter banking regulations left many companies underserved, creating an opportunity for private lenders to step in. These institutions offer flexible, customized financing options that can accommodate unique borrower needs, such as transaction size, structure, or timing.

For investors, one of the most appealing features of private credit is its use of floating interest rates, which adjust in real time with benchmark rate changes. This makes it an effective hedge against inflation and rising rates. Additionally, private credit offers higher yields than many traditional fixed-income investments (such as bonds), due to the illiquidity premium and credit risk taken on by investors. In today’s high-rate environment, private credit’s speed, certainty, and adaptability have made it a go-to solution for investors seeking alternatives to traditional bank financing.

Why Are Investors Turning to Private Credit?

Private credit offers a number of appealing features for investors, including a combination of higher returns, diversification, and lower volatility. Direct lending, the most prevalent private credit strategy, has consistently outperformed leveraged loans and high-yield bonds, particularly in periods of rising interest rates. From 2008 to 2023, direct lending delivered average returns of 11.6%. Rather impressive, when you consider that the returns for leveraged loans and high-yield bonds were 5% and 6.8% respectively1.

Additionally, private credit is perfect for portfolio diversification. Since it has such a low correlation to public markets, private bonds can help reduce volatility and improve risk-adjusted returns. Historical data also suggests that private credit has shown resilience, with lower loss rates than many public fixed-income instruments. These characteristics make it an attractive option for institutional investors seeking to enhance their portfolios.

Challenges and Opportunities

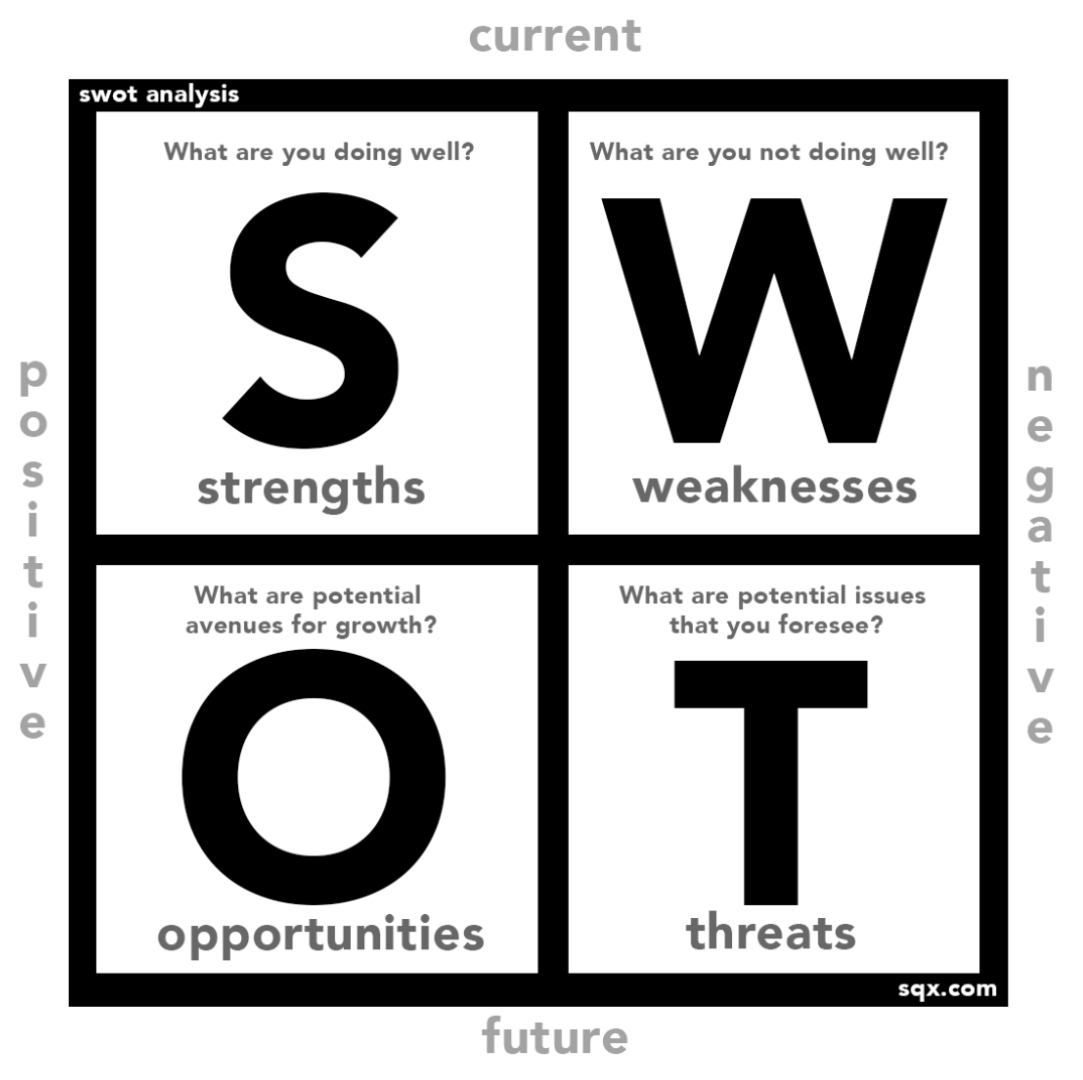

As private credit continues its meteoric rise, private credit investors face a mix of challenges and opportunities. Rising interest rates and economic uncertainty highlight the need for rigorous risk assessment and proactive liquidity management—particularly as tighter credit conditions may lead to increased borrower defaults. However, these same pressures can create attractive opportunities. Rescue financing, junior capital solutions, and bespoke lending structures enable investors to target higher yields from the borrowers’ unique challenges. As these trends continue, the potential for investors to grow and adapt in this space remains vast.

SQX: Supporting the Private Credit Ecosystem

The private credit market is poised for expansion. But this growth is only possible with the aid of accurate financial data—particularly for pricing private bonds—which are critical for risk management and compliance. SQX is a trusted partner in this evolving landscape, offering precise and transparent private bond pricing, secure data delivery via SFTP or API, and industry-leading customer service. With our commitment to transparency and responsiveness, SQX ensures financial institutions are equipped with the tools they need to navigate the evolving landscape of private credit.

As private credit continues to reshape the financial industry, partners like SQX will remain integral to its success, providing the foundational data required to support this rising market.

1“Understanding Private Credit,” Morgan Stanley. Jun 20, 2024.

Want more SQX updates? Follow us on LinkedIn to stay in the loop!