Evaluated Taxable Bonds

Accurate. Cost Effective. Independent. Customized.

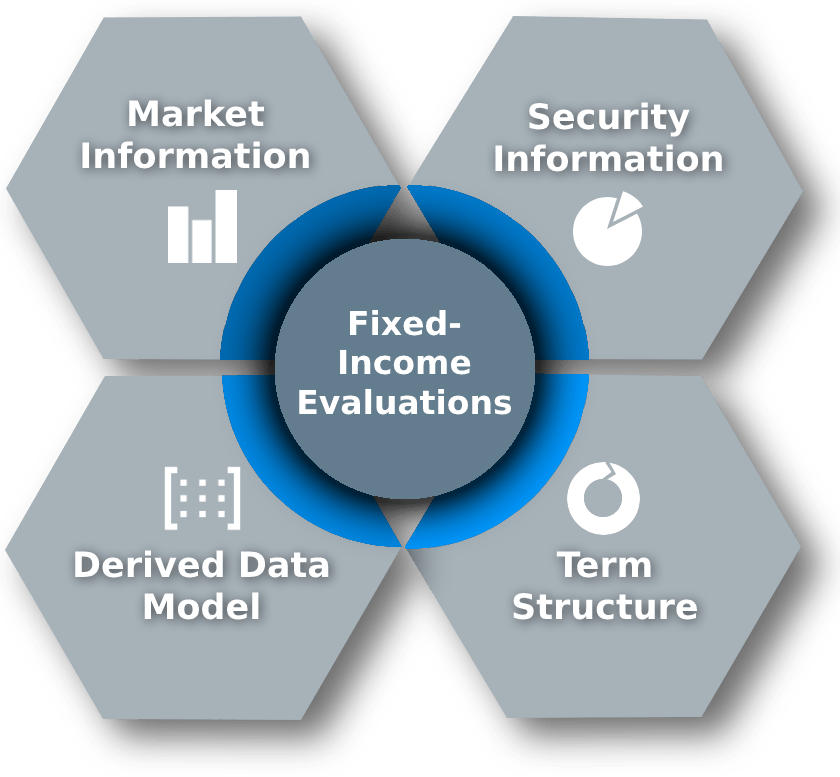

SQX provides independent pricing for fixed income securities using advanced proprietary methodologies.

- Coverage includes a global universe of both high-quality and high-yield corporate bonds and sovereign-debt.

- Customizable data feeds can include hard-to-price bonds, including high yield and emerging markets.

- Algorithmic pricing reduces risk by providing more precise evaluations than traditional methods

- Illiquid securities are evaluated using curve pricing and the relative spread of the security to better reflect the market

Contact a Product Specialist