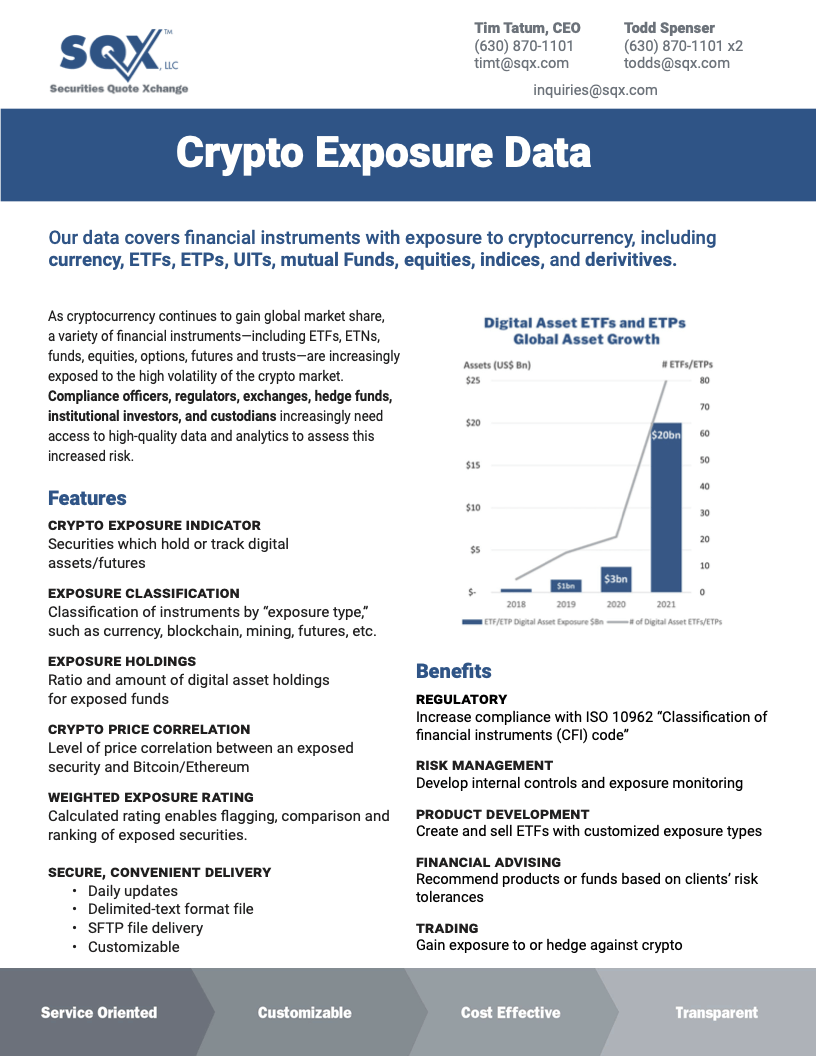

Crypto Exposure Data

Our data tracks financial instruments with exposure to cryptocurrency, including ETFs, ETPs, UITs, mutual funds, indices, equities, and derivatives.

Benefits

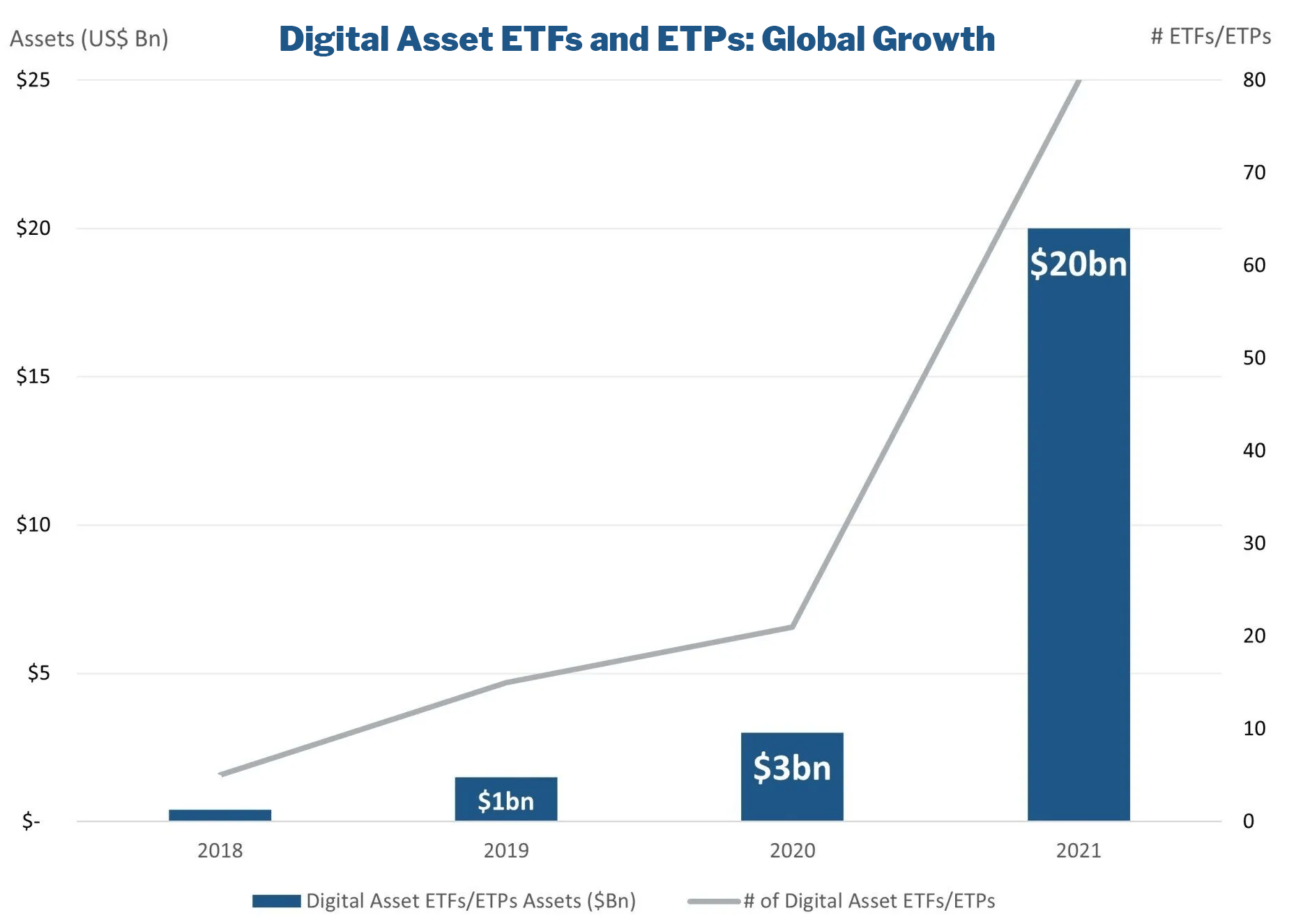

As cryptocurrency continues to gain global market share, a variety of financial instruments—including ETFs, ETNs, funds, equities, options, futures and trusts—are increasingly exposed to the high volatility of the crypto market. Compliance officers, regulators, exchanges, hedge funds, institutional investors, and custodians increasingly need access to high-quality data and analytics to assess this increased risk.

regulatory

Increase compliance with ISO 10962 “Classification of financial instruments (CFI) code”

risk management

Develop internal controls and exposure monitoring

product development

Create and sell ETFs with customized exposure types

financial advising

Recommend products or funds based on clients’ risk tolerances

trading

Gain exposure to or hedge against crypto

Features

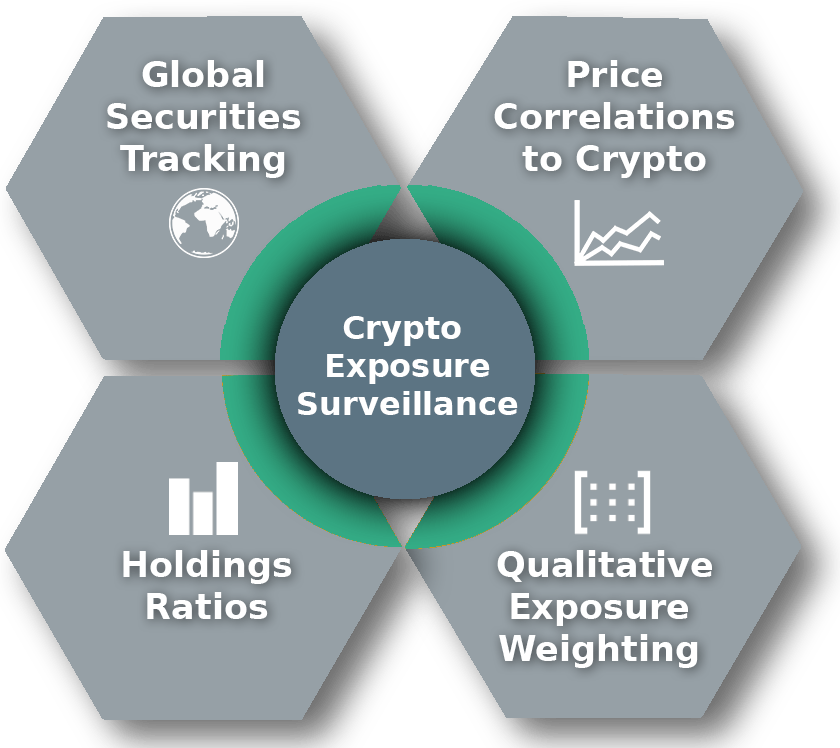

crypto exposure indicator

Securities which hold or track digital assets/futures

exposure classification

Classification of instruments by “exposure type,” such as currency, blockchain, mining, futures, etc.

exposure holdings

Ratio and amount of digital asset holdings for exposed funds

crypto price correlation

Level of price correlation between an exposed security and Bitcoin/Ethereum

weighted exposure rating

Calculated rating enables flagging, comparison and ranking of exposed securities.

secure, convenient delivery

- Daily updates

- Delimited-text format file

- SFTP file delivery

- Customizable

Explore our Data

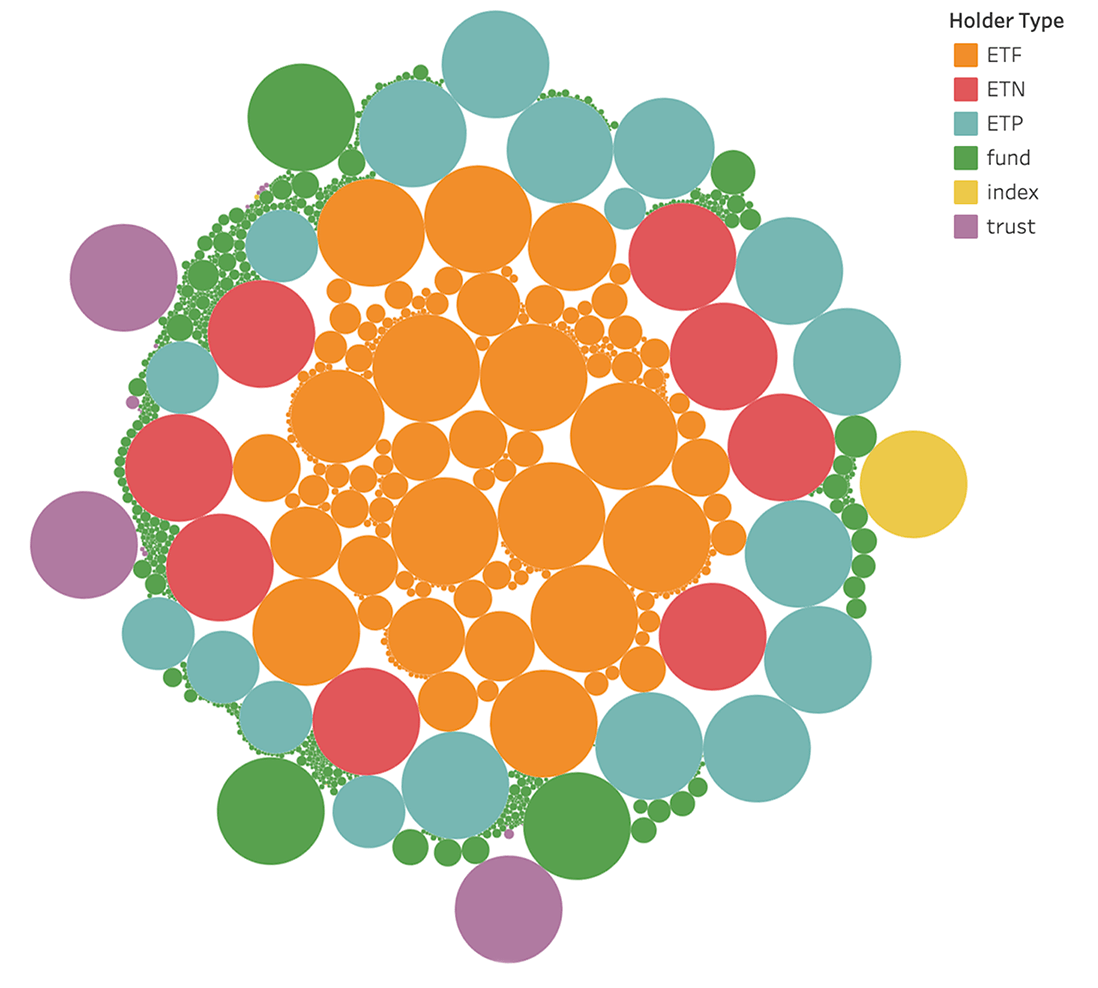

Sample Visualization of Crypto Exposure Data. Circle size corresponds to level of exposure

Consult a Product Specialist!

Learn More by Speaking with a Product Specialist

We will get back to you as soon as possible.

Please try again later.